💥An ascending triangle is a type of pattern that can be found in technical analysis. It is formed when the price of an asset moves within a converging range, with a horizontal resistance line at the top and an upward-sloping trend line at the bottom. This pattern is a bullish continuation pattern, which means that it is likely to result in the continuation of an existing uptrend once the pattern is broken.

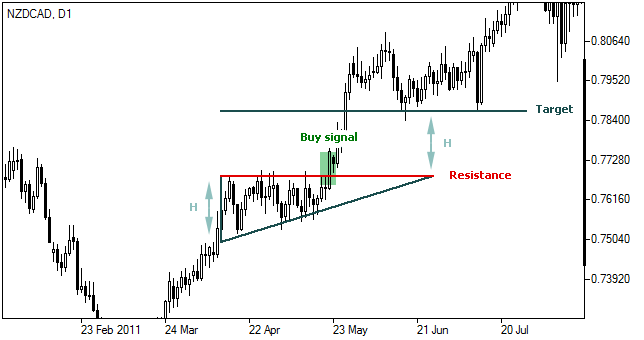

💥To identify an ascending triangle pattern, traders look for a horizontal resistance line and an upward-sloping trend line that connects at least two lows. The resistance line should be roughly flat, while the trend line should slope upwards. These lines should converge towards a point.

💥Traders often look for a breakout above the resistance line to confirm the pattern, as this indicates that buyers have gained enough momentum to push the price above the resistance level. They may also use other technical indicators and analysis to confirm the direction of the breakout and determine potential entry and exit points for trades.

💥Once the price breaks out of the ascending triangle pattern, it is likely to continue moving upwards, with a potential price target equal to the height of the pattern added to the breakout point. However, if the price fails to break out and instead falls below the upward-sloping trend line, the pattern is considered to be invalidated.

💥In the Ascending Triangle pattern (see picture), you can observe that it is similar to the triple tops pattern, but with a difference. During the formation of the Ascending Triangle pattern, the lower highs are higher than the previous lower highs, for example, 3 is higher than 2, and 2 is higher than 1 (while in triple tops, the lower highs are approximately at the same level with each other). This can help analyze whether the price is likely to continue moving up and how much it will move up after breaking through the resistance level.

💥Based on technical analysis principles, it can be analyzed that the price is likely to move up to a distance equal to or close to the distance measured from point A to the resistance level. Therefore, those waiting to sell should be prepared to take profits at that level. When the price drops, it can be bought (if it does not go down much until it changes the trend in the form of reversal patterns) because the adjustment is a minor correction in a big uptrend.

💥In the example above, both pictures show that the SET index formed an Ascending Triangle pattern at some point, which allowed it to maintain its original uptrend. Before the Ascending Triangle formed, the SET index was already moving up. After the pattern formed, the SET index continued its uptrend.

💥In the first example image, the principle of finding price targets was applied when the price was able to break through the horizontal resistance line of the Ascending Triangle pattern. It can be observed that the share price adjusted and fluctuated somewhat along the predicted line, which means that there will be short-term profits. However, for this case, short-term profitability cannot stop the determination or strength of the SET index, as it continues to climb up unceasingly. Those who sold in haste will rush back to buy back in order to continue being in the market.