Today's article will not be quite ordinary.

We often write articles relying on the fact that most users have experience in trading on the exchange. However, among our readers, there are more and more people who do not have knowledge about the exchange, brokers, the market and trading in General.

We would like to change this and tell you a little bit about the structure of trading, so that everyone, even a beginner, has an idea of what they might face.This will not be a manual for dummies, it will be an article that helps the user who first came to trade navigate.

First, let's tell you what the exchange is and how it works.The exchange is a fundamental link in market trading.It, like any commercial enterprise, is a legal entity and its activities are regulated by regulations and legal acts established by the state.

First, let's tell you what the exchange is and how it works.The exchange is a fundamental link in market trading.It, like any commercial enterprise, is a legal entity and its activities are regulated by regulations and legal acts established by the state.An exchange is a mechanism through which various market participants interact, which are consumers of various financial instruments, such as:

currencies, raw materials, and securities.

As mentioned earlier, the exchange's work is strictly regulated, so we can firmly say that its work is strictly ordered, namely: - Trading is not chaotic, but orderly, strictly at a set time, with strictly set instruments,

- Trades are held strictly in a designated place or on a strictly approved virtual trading platform (electronic exchange),

- The requirements and terms of trade for each exchange are unified, which makes it possible to comply with the procedure for transactions, requirements for the quality of goods or services provided, depending on the type of exchange,

- The trading mechanism is carried out through counter offers of purchase and sale by interested market participants.The purpose of the exchange is to organize and regulate the markets of the financial instruments that it represents. The exchange regulates the supply and demand process in order to equalize prices and protect the interests of all trading participants from various negative price changes.

Today, there are a huge number of exchanges, each of which trades various financial instruments. You can see the choice of a variety of trading platforms when working with trading programs. For example,

S#.Terminal allows you to select the trading platform that the user needs, including a large number of electronic exchanges.

This abundance is both positive, as it leads to increased trading opportunities, and negative in terms of the complexity of the choice for the novice, although the latter is rather subjective, since later, the trader understands the trading technique, gets the opportunity for more flexible trading.

The emergence of the first exchange in the XV century, we owe the Belgian city of Bruges. It was on its Central square that the first auctions of securities – bills were held.

Not far from the place of trade, the house of the

Van der Beurse family was located. Later, these trades were taught the name

Borsa, which over the years was transformed into the word

"stock market" or "exchange". .

What are the rules for trading on the stock exchange:

- Transparency and openness of operations,

- Free pricing

- The state does not interfere in the course of the auction, but the auction is regulated by law.

- Along with manual trading, it is possible to use automated trading systems. For example, such as S#.Shell, MT and others,

- The exchange receives income from Commission on transactions.Trading opens up great opportunities for the participant to earn money.

Today, both an experienced trader and a novice can become a market participant.

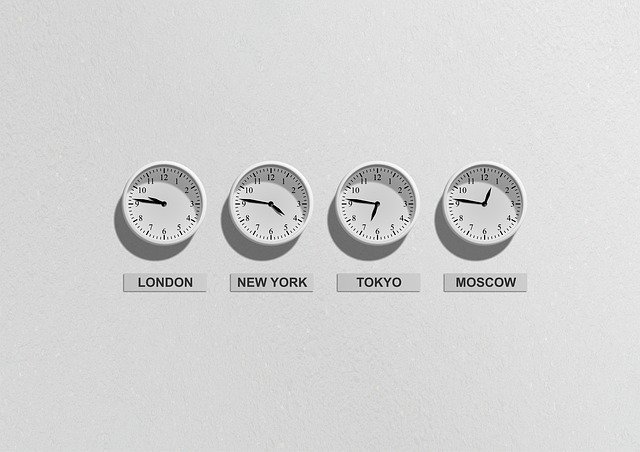

The abundance of trading exchanges allows you to choose what and where to trade. The largest exchanges include:

Chicago, Tokyo and

Sydney commodity exchanges, the new York cotton exchange, the London metal exchange, the German futures (Frankfurt) and

Singapore currency exchanges, the European-American NYSE-Euronext, the St. Petersburg and

Moscow stock exchanges.

Becoming a trader is not always as easy as the advertising brochures promise, the player's path is thorny and inevitably involves losses and winnings. Of course, with experience and knowledge, a trader acquires a stable income, but at the same time does not stop learning and improving.

A trader studies the market, various trading terminals, and SOFTWARE.

Becoming a trader is real, but it is not always as easy as it seems.Therefore, we have

developed a training course for creating trading systems, which is designed for both knowledgeable traders and beginners. We have included a full range of training in algorithmic trading and the creation of trading systems, programs and examples of trading strategies.

The goal of the course is to make trading more accessible and understandable, to teach anyone to trade, and success now depends only on the trader and his desire.In the following articles, we will tell you how to choose a reliable broker and what a trader may face while trading. We will be happy if you share your experience and ask questions. Thanks