Recently, interest in crypto currencies has grown in leaps and bounds. New exchanges have opened, hard forks, ICO, new crypto-currencies are being created and this whole movement generates a huge sea of opportunities.

One of these opportunities will be discussed in this short article.

Not so long ago, we launched the

crowdfunding project to create new connectors to 10 crypto-exchanges (

Bitfinex, Coinbase, Kraken, Poloniex, GDAX, Bittrex, Bithumb, HitBTC, OKCoin, Coincheck), while the two connectors to Wex.nz and Bitstamp are already implemented in our platform. This project would not be needed if the currencies were traded more centrally, but the number of exchanges already exceeded a few dozen. More connectors, more stable trading, and more entry points for arbitrage bitcoins and other popular crypto currency.

The target function of any exchange is to match buyers with sellers, but the price of an asset at which bidders are trying to make a deal can be different! Since the digital assets economy is just beginning, this difference can be very significant.

This fact gives rise to the possibility of so-called arbitrage - to buy assets when they are cheaper and sell when they are more expensive.

Let's see an example. The screenshots below of exchanges are further made at the same time.

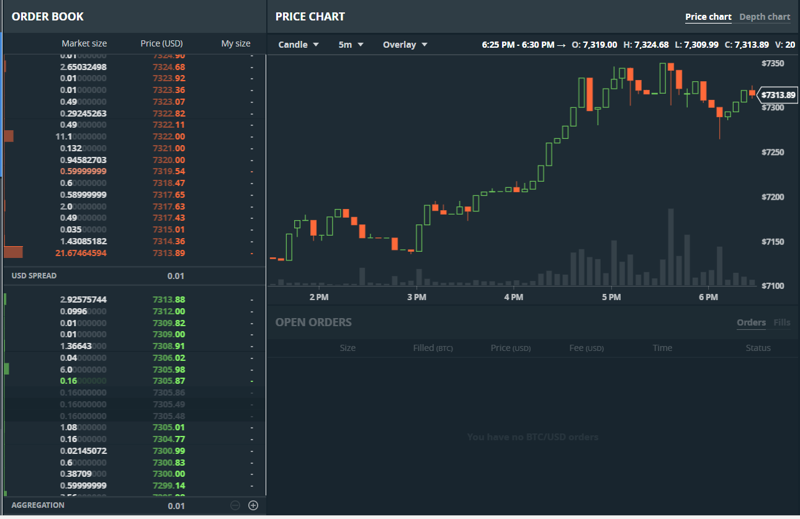

GDAX BTC order book:

BTC quoting by $7 313,88 price.

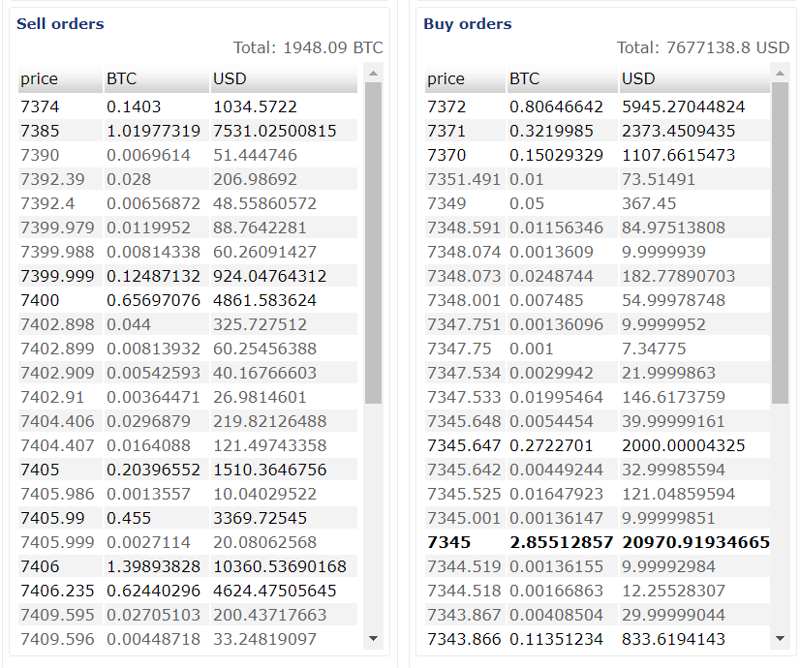

For the same BTC on Wex.nz

Same BTC but price already $7 373

Another exchange - Poloniex:

BTC has a price of $7 323

No comments ;-)

Join our shared campaign of creating new connectors and we will provide you with technical tools for arbitrage between exchanges (and, consequently, earnings on this strategy). Particularly important, we will provide an

automated trading robot, which has already been performing arbitrage trading with Bitcoin for almost a year.