As mentioned earlier, an

important advantage of working through

FIX Protocol is the ability to use limit orders

FOK ('Fill or Kill') and

IOC ('Immediate Or Cancel'). Their advantage over simple market orders is the absence of

price slippage. In fact, for arbitrage strategies, such as

"Edward-Scissorhands" from

StockSharp, this means almost

zero risk. Consider how the orders

FOK and

IOC FIX Protocol on the example of comparing them with conventional orders.

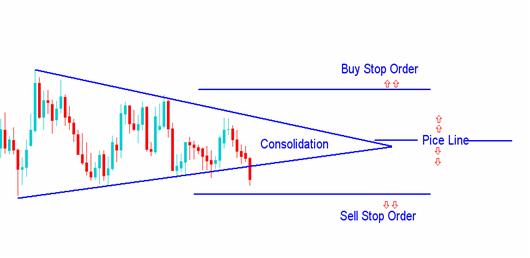

Before making a trade, the trader has the opportunity to

sell or buy the selected asset using a limit or market order. The option chosen by the trader determines the level of control over the execution price.

Thus, a market order determines its execution in the shortest possible time and at the best available price. [smile] For example, if you buy 100 units on a market order, the order will be executed entirely at the price that is available on the market. Accordingly, 50 units can be conditionally at a favorable price, and the rest at a price less favorable or completely unprofitable, in other words, the order will be executed at several different prices. At the same time, we have a situation with a large slippage. [laugh]

FIX Protocol allows the trader to set his own execution price, so it will be executed at the specified price or higher. This is the use of a limit order. For example, if a trader placed a limit order to sell an asset and set a strike price of $ 100, the order will not be executed until the price for the placed asset is equal to or above the set limit of $ 100.[nerd]

For this reason,

we recommend using the FIX Protocol connection, and provide the opportunity to purchase connection connectors or develop connectors individually. The full range of our products can be found

here.