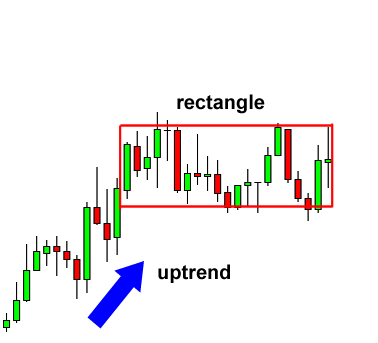

💥A rectangle is a chart pattern that signals a period of consolidation in the price movement of an asset. The pattern is formed when the price moves between parallel support and resistance levels, creating a rectangular shape on the chart. The support level is the lower horizontal line, while the resistance level is the upper horizontal line.

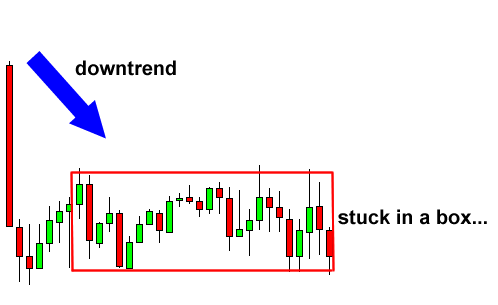

💥Rectangles can be either a continuation or a reversal pattern. A continuation pattern indicates that the price will likely continue moving in the same direction as the previous trend after the consolidation period ends. A reversal pattern, on the other hand, suggests that the price will reverse its direction after the consolidation period ends.

💥Traders can use the rectangle pattern to identify potential entry and exit points. In a continuation pattern, traders may look to enter a long position when the price breaks above the resistance level, while in a reversal pattern, traders may look to enter a short position when the price breaks below the support level. Stop-loss orders can also be placed below the support level in a long position and above the resistance level in a short position to limit potential losses.

⚡️⚡️As with other chart patterns, traders should use other technical indicators and analysis to confirm their trading decisions. The rectangle pattern is not always reliable, and false breakouts can occur. Therefore, it's important to wait for confirmation before making trading decisions.

💥The rectangle pattern is similar to the triple tops or triple bottoms patterns because it simplifies the explanation. Assuming the original trend is an uptrend, when triple tops are formed, prices retrace until they break through the base line and go down. However, the rectangle pattern is different. After the third peak, there is a downturn, but it appears to rebound from the bottom base line (as pictured), making it look less like triple tops. After careful consideration, prices continue to move up until they break through the resistance line, indicating that the rectangle pattern is a continuation, not a reversal like triple tops. Some may say that the rectangle pattern is no different from a sideways movement, which is probably correct, but let me tell you that there are some observations to distinguish between triple tops or triple bottoms and rectangles. Triple tops or triple bottoms are formed with a wider channel than the rectangle's channel. In other words, the up and down motion is more intense in the case of triple tops or triple bottoms than in rectangles.

💥If you understand the rectangle pattern in an uptrend, understanding the downtrend rectangle pattern should be easier. Just change the observation point from the bottom point to the top point, as shown in the example image.