The start and emergence of

algorithmic trading can be considered the 98th year of the last century, when the us securities Commission (abbreviated

SEC), decided on the possibility of using

electronic trading platforms, and as a result, the use of

trading robots for algorithmic trading.

All this gave rise to a leap in technology in the field of trade.

There are several periods that are particularly important:

-

the beginning of the 2000s, this period of technology allowed you to

make automatic transactions in a few seconds, despite the low speed it was a breakthrough, according to the

SEC calculation, robots account for less than

8% of transactions.

-

the end of the 2000s was characterized by an increase in the

speed of transactions up to milliseconds, during this period the number of transactions made by

trading robots exceeded 55-60%.

-

late period since 2010, the number of use of trading robots has decreased, and

amounted to about 45-50%. Experts attribute the decline in usage to an increased number of errors and failures of

trading robots.

Today,

algorithmic trading (

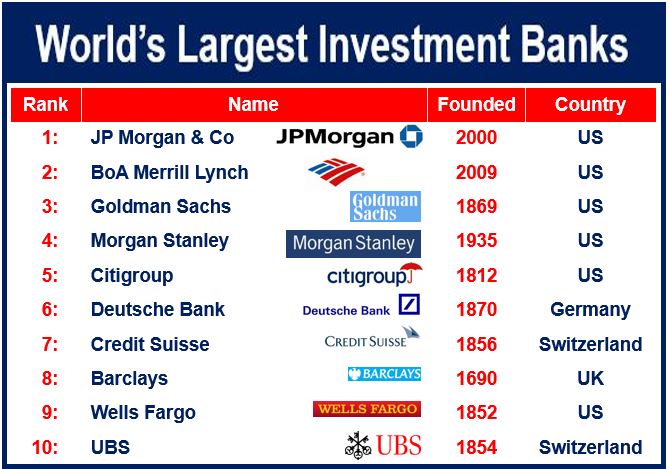

HFT trading) is one of the most important components of exchange trading. Not only private traders, but also large companies-invest. banks and funds use trading robots in their work.

The annual investment of companies in the development of tools for

algorithmic trading is growing, and the result of such developments brings its own income.

StockSharp has been

providing traders with all the necessary

tools for algorithmic trading for many years, starting with

connectors for

exchange trading and ending with

software that allows them to work on all

trading platforms around the world.

You can find more information about the list on our

website.