What is Arbitration, general concepts.

Recently, the concept of

Arbitration has been found quite often in trade. What is

Arbitration?

Arbitration is a

method of profit that minimizes the risk of loss by using the price difference for the same asset in different markets.

Today, this mode of trade is a commonly used trade tactic.Let us consider what this mode of trade consists of.

The point is to sell the same

asset at a higher price in one market and

purchase the same asset at a lower price in another market.

Such trade is one of the most important components of the market, and most traders seek to conduct such trade, effectively reducing the

possibility of loss to a minimum.

Although the nature of

arbitration consists of price differences of one asset in different markets, this strategy can be applied to two assets with similar prices and portfolio volume.

Consider what the arbitration portfolio is and its properties:

-

Arbitration portfolio - portfolio of assets,

which does not require additional resources of the investor.-

The arbitration portfolio is

not influenced by any factor, that is, has zero risk.

In fact, for an investor, an arbitration portfolio is a tool that allows it to receive a large return, while remaining unaffected by various risks.

A simple example of arbitration trade:Suppose the value of asset A on one of the exchanges is $100, while the value of the same asset on the other exchange is $105.

A trader acquires an asset on one exchange, where its value is lower, and sells it on an exchange, where the value of it is higher. Thanks to this strategy, the trader gains profit, in the form of price differences of asset A on various exchanges.

This example is quite simplified, and is given only for the sake of clarity, in real trade the implementation of such transactions has its own difficulties.

Choice of pair in arbitration.

Let us once again define

Arbitration Trade based on practical knowledge of it.

Arbitration trading is a method in which trading is carried out by means of differently directed transactions with an asset or assets

having similar prices and portfolios,

based on the difference in their value. In fact, the

trader buys a cheaper asset and sells a more expensive asset similar to the first asset.Often, the arbitration pair selects a base and derivative asset (for example,

shares and stock futures). Both assets should have similar price dynamics -

correlation.

However,

correlation has the property of being broken for various reasons.

Such reasons can be related to various serious market changes and to the consequence of market inefficiency. Emerging

correlation violations contribute to profit in arbitration transactions. In fact, the trader profits when the correlation of the underlying and derived asset is restored, after its violation.

Simply put, an

arbitration transaction occurs when buying a cheap asset and selling an expensive asset when there is a difference between their prices in view of various factors. However, for the rest of the time, the prices of both assets tend to be equivalent.

Types of arbitration trade.

Let 's look at what types of arbitration are distinguished in trading:

-

Time arbitration;-

Spatial arbitration.Temporary arbitration implies that transactions occur with a time difference. This type of arbitration is

characterized by a mechanism: buy cheap, and sell expensive, or vice versa, sell expensive, and buy cheap. To put it simply, such a mechanism is actually - a common speculative transaction m

ade on the stock exchange market.

Temporary arbitration contains a risk, as

during the period of time the trend may not change the direction of movement, that is, if the trader initially bought the asset for cheap, it is not a fact that after time the asset will not cease to be cheap, thus bringing a loss on sale.

The next type of

arbitration is spatial. With this type of arbitration, a couple of

transactions are bought and sold at the same time but at different sites. In such transactions

risk is minimal, and sometimes at all reduced to zero, as a couple of transactions take place simultaneously, at the same time the trader should take into account not only the difference in the price of the asset, but also possible commissions, which should be included in the expenses and covered by the amount of profit.

In addition to the types of transaction time, arbitration is divided into trading methods. Let 's look at the main ones and explain them.

Spatial arbitration is divided into the following types:

-

Equivalent arbitration;

-

Regulatory arbitration;

-

Calendar arbitration;

-

Percentage arbitration.

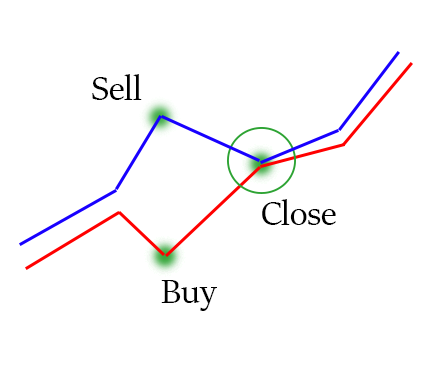

Equivalent arbitration refers to such transactions in which the

underlying asset and derivative asset (derivative) are considered. Since the price of a derivative always strives for the price of a basic asset, price schedules go alongside each other, sometimes intersecting and diverging.

If we simultaneously open equidistant positions on the selected asset and its derivative, when they have the maximum divergence, then closing the position when they converge will make a profit.

Regulatory arbitration is based on the

difference in price caused by different rules in different jurisdictions (areas, countries, unions).

For example: due to certain legislation, an asset in one region is sold with a markdown, and its price is correlated with prices in other regions, differing by a stable markdown difference. In this way, by purchasing an asset in one region and selling it in another, you can earn a profit in the amount of a markdown.

Calendar arbitration is based on the

difference in price arising between futures on the same asset but having different delivery times. This difference is called a calendar spread. The subsequent trading mechanism is similar to the equivalent arbitration method.

The last type is interest arbitration. This arbitration takes place on the foreign exchange market (Forex), and there are two types:

-

No forward coverage;

-

With forward cover.

The essence of arbitration is that the currency is bought and placed on a deposit with a set percentage. The currency is then sold at the current market rate. If the currency purchase occurs with the sale of a forward contract for the same amount, arbitration with forward coverage. With this type of risk is minimal, and for frequent absence.

If the purchase is made without forward support, arbitration without forward coverage. Such arbitration may be accompanied by a large risk based on a change in exchange value, which may result in a loss that is greater than the percentage of income on the deposit.

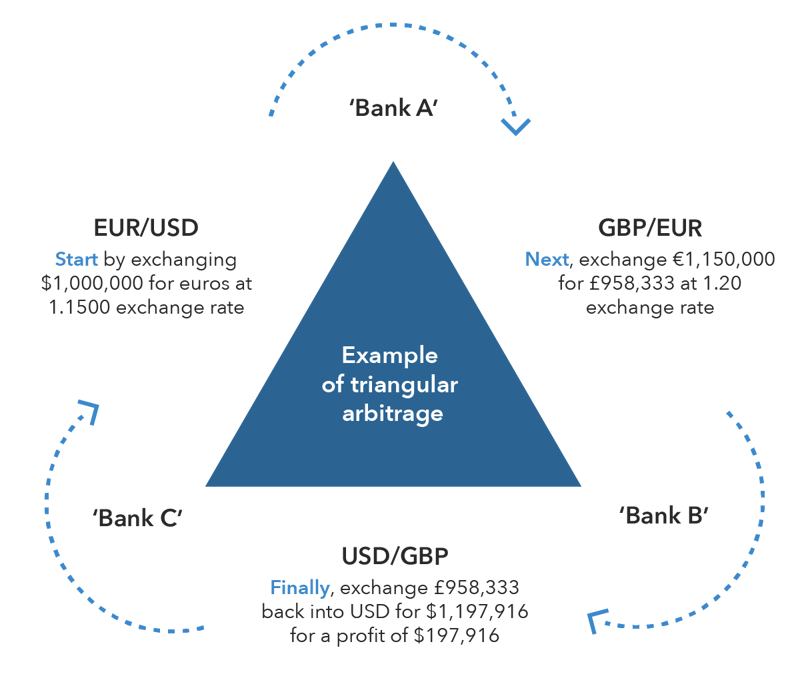

Triangular arbitration is also common in the Forex market. Let 's look at it with an example:

The trader buys

EUR/USD, sells

EUR/GBP at the same time, and buys

USD/GBP. An equilibrium triangular contour is created. It turns out that the trader bought Euro for dollars, sold Euro for Pounds, Bought Dollars for Pounds. Thus, a closed chain is obtained, on the imbalance of which profit is made.The scheme of such arbitration is shown below:

Conclusions

Arbitration trade has gained a lot of recognition among traders. A large number of approaches to solving the problems of

arbitration trade, a large number of methods used to implement the tasks make this kind very flexible, and the absence of risk or its minimum value further popularizes it.

However, it is worth saying that the strategies of arbitration to direct, are related to the rate of reaction of the trader to changes in the asset. This leads to various requirements that promote successful trade:

-

Fractions of a second play a major role in arbitration strategies. Therefore, such

trading systems require good software. It can be represented by ready-made trading robots. For example, StockSharp offers the robot

"Edward", which allows you to work using the trader's

arbitrage strategy and is capable of quick and

flexible configuration.High-quality software is especially important when working for

Forex, as the number of traders is high. Therefore, many prefer an individual approach and create trade robots on their own through various programs. Trading robots are mostly written in powerful

C# or

C++ languages, using libraries such as

S#.API and

Interactive Brokers API.

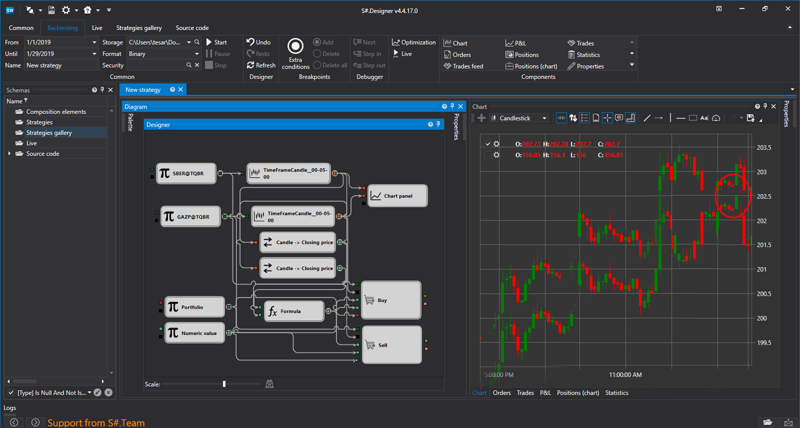

Recent years have also received designers of trade strategies

TSlab and

S#.Designer, which allow to create trade robots without programming.Below is an example of a trading robot created using S#.Designer, the graph shows the moment of divergence of assets and their convergence with the subsequent transaction by the robot.

Application of the latest software leads to reduction of risks and improvement of the mechanism of work and as a result to increase of profit.

-

It is important to remember that the strategy, even if there is perfect software, is profitable, if the income will exceed the possible risk and all broker commissions.-

It is worth remembering even using a trading robot, the risk can not always be reduced, so the trader must constantly manage his strategy, improve his tools and his knowledge. Learning new principles that can be applied in trading can make a trader a pioneer in making profits.

It is necessary to know that arbitration strategies can and should be combined with other types of exchange trade, which will give additional opportunities in income generation.