Earlier, we said that the

FIX Protocol not only increased the

speed of traders in the market, but also provided an opportunity for market participants to use

limit orders, which reduced the risks of trading. Let's take a closer look at two types of limit orders.

Let's start with the

FOK order.

Literally, its name stands for -

'Fill Or Kill'. The essence of this order is that it is

executed immediately and in

full at the stated price, or will not be executed at all, which eliminates the possibility of slippage. Thus, if your order

cannot be executed in full, then the order is

simply rejected, if the order

can be executed in full, then the

order is executed in full at the specified price. [nerd] This type of order is very

convenient for

scalping or

arbitrage strategies, as they

eliminate the risk of slippage. In fact, we can say that the

"Edward – Scissorhands" arbitrage strategy from StockSharp

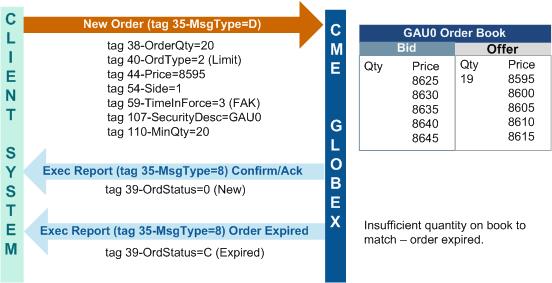

eliminates risks. Below is an example of the rejection of the

FOK order in the

CME system, due to the fact that the

order size is 20, and the

book contains only 19, so the order

can not be executed completely, and the system cancels it.

The next type of limit orders are

IOC orders.

The name

'Immediate OR Cancel' means that the

order is executed in whole or in part at the set price, otherwise the order will be canceled. For example, if the

order size is 100 units, only

50 units can be sold at the set price. If we use an order of type

FOK, the system will cancel it, as it can not be fully executed. When using the

IOC limit order, the order will be

executed for 50 units, and the

remaining ones will be canceled.

IOC also has another name

FAK, which stands for

'Fill And Kill', executed and discarded the remainder.[nerd]

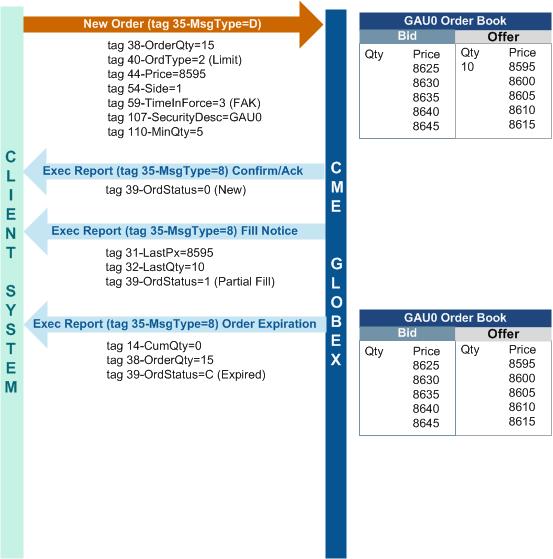

For example, an

IOC order will be partially executed (in the

CME system, its name is

FAK). If we

buy 15, and the book

contains only 10, then we

buy 10, and the

remaining 5 are rejected, so this order can be called partially executable:

Limit orders

Limit orders when working through the

FIX Protocol allow the trader to

reduce risks, and in some cases, especially when working with

arbitrage strategies to

reduce them to zero. Our company provides a range of programs to work in the market through

FIX connect, such as: designer trading strategies

Designer, trading program

Terminal. We also provide a full range of connectors for connection to trades, including FIX. Flexible system of discounts and reliability of connection, makes us one of leaders in the market. The full range of connectors and software can be found on our

website.