(bitcoin arbitrage)Abstract:"This robot is the most low-risk and will suit almost any trader who creates his own set of systems. The robot is based on the well-known principle of arbitration and trades exclusively with correlated assets.

(bitcoin arbitrage)Abstract:"This robot is the most low-risk and will suit almost any trader who creates his own set of systems. The robot is based on the well-known principle of arbitration and trades exclusively with correlated assets.

The robot operating principle is based on the difference in the prices of the futures contract and the underlying asset, higher than the user-defined interest rate and the yield step. Only two of these parameters determine the robot operation procedure.

If the difference between the share price and the futures reaches the interest rate + yield step, the robot sells the futures and buys the spot. When the pair converges, the robot makes a reverse trade.

With any market move, the trader remains in the black (the main thing is not to forget to take into account the commissions when setting the profitability step). In general, this is the most stable algorithm in our list, which allows you to make a profit of the market a little, but stable."How everything works:Let's begin with a little theory.Arbitration is the gaining of profit through the making of several logically related trades. The robot allows you to automate the process on making of these trades.

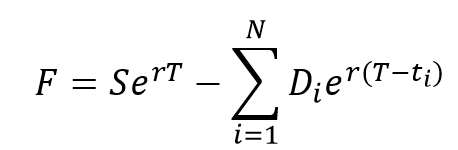

Futures is a derivative financial instrument. It is called a derivative, because its price is a derivative of the spot price of the underlying asset. The formal relationship between the price of the underlying asset and the futures is expressed by the following formula:

Where F is the futures price,

S - Spot price of the underlying asset,

r - Risk-free interest rate,

T - Period before the expiration of the futures contract,

D

i - dividends on shares that are guaranteed to be paid in the period ti where 0 < ti <T

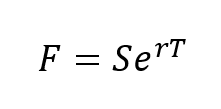

In the event that dividends are not paid, the formula for estimating the value of futures is reduced to:

Thus, you can notice that the most important parameter is the interest rate, which, in fact, will be operated by our robot.

Perhaps it's time to move on to practice and show, using the example, the basic principles of the algorithm

Consider the futures on the share of Apple. Today on June 22, 2017 at 14:30 the following prices were on the market:

S = 144.76

F = 14 812

Expiry date of the futures 21.09.17

By simple calculations we obtain for r a value of 9.2% per annum.

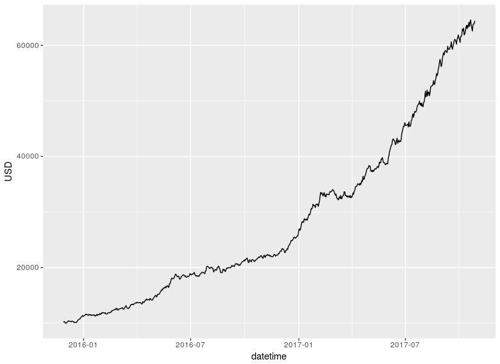

As the market is constantly in motion, the interest rate is unstable and varies depending on the convergence/divergence of spot and futures prices. Here, there arises the possibility of arbitration.

The robot allows you to specify an underlying asset, a futures, a possible dividend (for correct calculation of the futures price), a risk-free interest rate and an interest rate step for entry and exit, traded volume (indicated for futures, for share is calculated automatically).

For example, for Sberbank in case of specifying a risk-free interest rate at 9.2% per annum and a step of 0.2%, the robot will operate according to the following algorithm:

1. The first trade to buy a spot and sell futures will be made at a rate value of 9.2%,

2. The rate increased to 9.4% - the robot will open an additional volume.

3. The rate increased to 9.6% - the robot will open an additional volume.

4. The rate dropped to 9.4% - the robot will close the last collected volume

5. The rate dropped to 9.2% - the robot will close the second collected volume

6. The rate dropped to 9.0% - the robot will close the position completely.

In such a simple manner, the robot arbitrates a pair of spot-futures. Only the correct indication of the interest rate for which the operations will be performed is required from the user.

The potential yield of this algorithm is 20% per annum!