In previous time we’ve reviewed and analysed trading software for

algorithmic trading. Let’s continue our analysis of trading systems.

- The next system will make

volume analysiss of orders by tool and will determine the largest one. This system we call -

Front running. A robot makes a decision where the largest order holds the price and force traders to trade in opposite direction.

- Another popular trading system is

arbitrage algo robot. By trading with this robot the trade continues by the tools where correlation of is almost equal to 1. By tool we meant stocks and futures. Shares of the same issuer in different

markets are also used. The robot monitoring price flow of financial instruments and make mirror trades, sells one out and buys another to balance the price. One of such robots is

"Edward - scissor hands" which is a product of StockSharp company and able to do arbitrage trading and make a profit for traders.

- One of the most complex in terms of knowledge and technical base is

volatility trading. The original principle based on buying options of different types, taking that a potential growth of volatility of a securities with expectation that the volatility of a certain securities will growth.

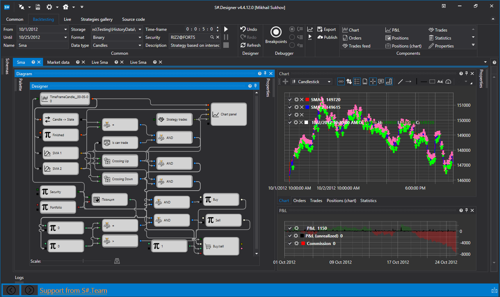

All represented types of algo trading have a myriad of trading systems. Our company developed such programs as

S#.Designer which allows traders to trade in any direction. The trader have an opportunity to build a robot with help of constructor and sets any parameters for strategy.

More about S#.Designer you can find on our

website.